The total structures destroyed by the Dixie fire in California is so far not high enough to make it a substantial reinsurance event, sources have told Trading Risk.

As of last week, the damage was reported at 1,027 structures destroyed, which had risen to 1, 173 with a further 80 properties damaged based on the latest CalFire updates on the evening of Sunday 15 August (Pacific time).

So far, the damage caused is thought to cost sub $1bn with one source pegging it at that level while another suggested it could be in the mid-$100-millions.

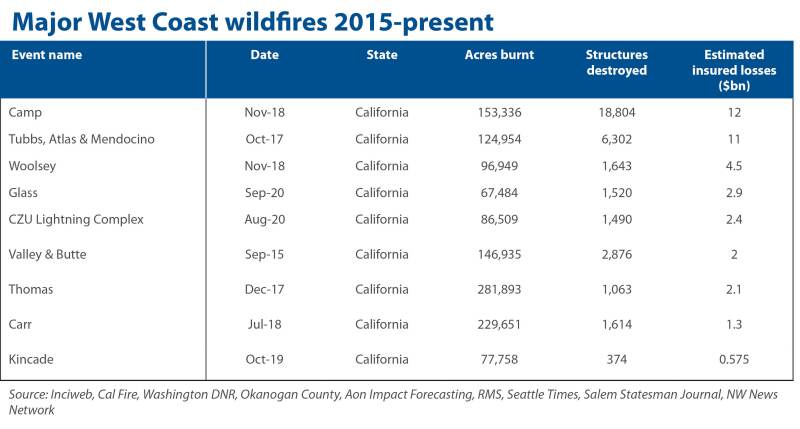

But when comparing the blaze to the red-letter Camp fire in 2018, which caused $12bn of insured losses after destroying 18,804 structures, sources downplayed the relative impact of Dixie.

Despite this, caution was urged about how costs could develop as 16,035 structures are at risk due to the fire, according to an update from Cal Fire at 7pm (PT) on August 10.

Dixie is currently burning through more than 490,205 acres and is just 27% contained, which one source said means it would likely still be active for weeks to come, opening up the possibility for more severe destruction of property.

Last week the fire swept through the gold rush town of Greenville, destroying 75% of it according to the National Interagency Fire Centre.

The average price of a house in this area is $243,727, more than $50,000 lower than the U.S average of $298,933, according to online estate agent Zillow.

In light of this, there was agreement among sources that Dixie wouldn’t trigger the same loss levels as other record-breaking fires in recent years.

The Woolsey fire of November 2018 California left an insured loss of $4.5bn and destroyed 1,643 structures, only 600 more than Dixie has done already, but it hit the north of Los Angeles and Malibu area where the average house price is around $3.7mn, according to Zillow.

The Thomas fire destroyed 1,063 buildings from December 2017 to March 2018, leaving an insured loss of $2.1bn but again, this affected areas of Santa Barbara and Ventura where the average house prices are upward of a million and $250,000 respectively.

Sources suggested that claims from Dixie could be covered through subrogation or utility liability policies, because the energy provider PG&E's role in the fire is being investigated. The utility released a filing on July 13, saying a blaze had been found near a tree leaning into a conductor, although later reports said prior inspections had found no faults with its equipment.

However, on Monday the firm said inspectors found no problems with power lines, power poles or the tree which it initially suggested could be linked to the Dixie Fire, the Sacramento Bee reported.