That tension between the opportunity afforded by better prices and the challenge of raising capital to attack this opportunity will thread through the coming year.

If anything, it will become more pronounced than it is right now, if predicted economic recession adds complexity to allocators’ already well-documented challenges of handling the impacts of inflation, interest rate hikes, and the economic knock-on effects of the Ukraine War on their portfolios.

These conditions indicate that ILS is entering an accelerated period of change to products and services, having achieved significant gains to terms and conditions in recent renewals, from extension spreads on cat bonds to higher attachments on cat treaties. At the same time, modelling around climate change becomes more sophisticated.

Here we set out the five biggest drivers of change for ILS in 2023:

Investor base rotation

ESG challenges

Ongoing non-cat ILS demand

Inflationary pressure

Platform evolution

Rotation of the investor base

The start of the year could see a return of private equity to ILS, as happened in 2006 after a hard market formed off the back of Hurricane Katrina losses. Market participants observed that multiple firms which dipped into reinsurance in the post-Katrina period were considering a return across a range of ILS products.

Of five funds named in a New York Times article about the capital influx to ILS and reinsurance that year, Citadel and Magnetar are still in the game, and sister title Inside P&C named various PE firms considering the market last year.

On the cat bond side, one source suggested asset managers that passed on the soft market but stayed on the mailing lists for cat bonds were now getting in touch based on the elevated pricing opportunity.

By the year’s end, average gross coupons on Q4 issuance surpassed 9%, according to Trading Risk data, with projected margins above 7% after accounting for expected loss.

Institutional investors are by nature slower-moving and have constraints on what percentage of assets they are permitted to allocate to ILS. They therefore react less quickly to pricing movements than more opportunistic investors – whether it comes to PE, multi-strategy funds or high net worth.

However, while there might be some rotation as to the type of investors that come into the market this year, the lack of capital entry to the scene by 1 January and the relatively orderly completion to the renewal must depress hopes around capital raising. Vantage’s capital raise for a cat fund was the only notable launch in December, with the size closely guarded.

ILS managers indicate they expect relatively modest inflows here and there throughout 2023-2024, with a small continuing skew to cat bond strategies, whose track record has aligned more closely to their sales story in recent years compared to other forms of ILS.

Expectations around inflows in general and bigger deployments in particular have shifted from “will come in Q1” to looking out over a longer horizon, both to mid-year and beyond. Talk of investors with the firepower to deploy bigger sums actively looking at ILS comes with the caveat that a pitch resting on “more of the same with additional rate” may not be compelling enough to compete with opportunities in other asset classes.

Others expected smaller-ticket inflows in the meantime.

The industry also needs to overcome poor prior-year performance, which has dragged down five-year average track records. Even with the Irma losses of 2017 ageing out of this dataset, the ILS Advisers index shows a 3% drop since 2018.

ESG outlook mixed

ILS firms that have been on an ESG journey from the outset have been navigating a patchwork of regulations coming out of different jurisdictions around the world. If anything, the ESG map became more partitioned last year.

In Europe, general ESG tenets are broadly accepted, and policy has reflected that, with the SFDR rules becoming more refined and embedded in the investment landscape over time. Zurich-based ILS firm Twelve Capital showed what can done, achieving a dark green article 9 classification for its Climate Transition Equity Strategy in November. Independent cat bond house Plenum, also operating out of Zurich, has an article 9 accredited fund.

The picture in the US is more complicated, with pockets of backlash emerging during 2022 in Republican states and where the oil and gas industries remain big wealth generators. The US and UK are currently consulting on their ESG disclosure regulations.

The next significant step forward would be the launch of an ESG-specific ILS fund or new issuance of “green” cat bonds, which has not been seen since Generali’s 2021 deal.

The regulatory scene suggests it is more likely to happen in Europe first, and certainly it could tip the balance as a differentiator for the right investors.

Non-cat ILS evolution

Given ongoing caution around catastrophe modelling and loss experience, casualty ILS and cyber ILS will continue in their early-years development phase, evolving and growing through 2023.

There’s a call in both segments for pioneering investors to come in that would help to advance the markets, providing data points for others to build on.

In casualty, Ledger, RenaissanceRe’s Fontana Re, and a planned fund from Vesttoo are at varying stages on this journey, and casualty ILS will likely step up a level in 2023.

On the cyber side, inflows are likely to increase as modelling continues to develop.

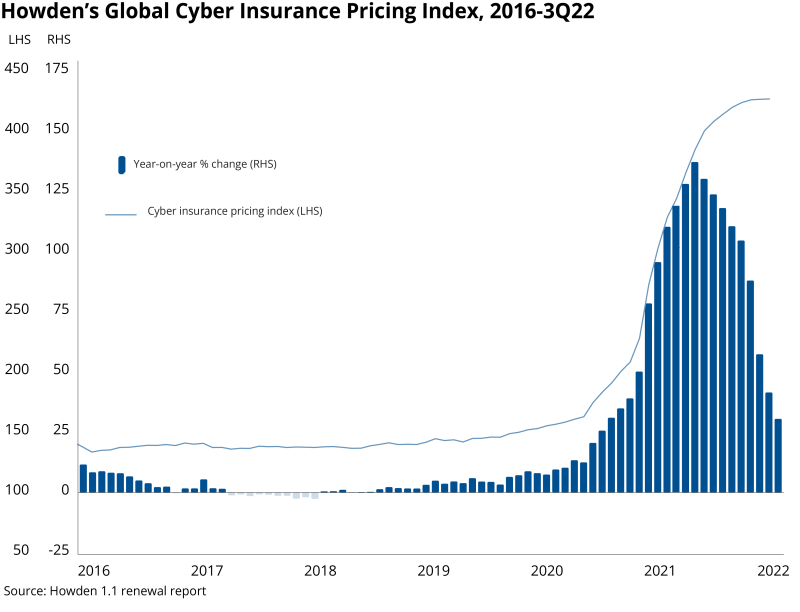

Here again, pricing has been a big pull factor. Howden’s Global Cyber Insurance Pricing Index shows that, though the rate of premium increase slowed during 2022, pricing in the primary market remains at historically high levels.

The year has opened with placement of the first cyber catastrophe bond, a $45mn transaction from Beazley which pays out if the insurer’s losses top $300mn. The deal fires the starting gun on what could become a lively new segment of the cat bonds market this year.

Inflation concerns drive discipline

Inflationary pressures seem likely to continue for the coming year at least, with the Ukraine War ongoing and Covid still prevalent.

The IMF’s second in command, Gita Gopinath, recently called on the Fed to press ahead with interest rate rises despite a recent moderation in headline inflation. In the Financial Times, she argued that US labour market indicators particularly suggested “we haven’t turned the corner yet on inflation”.

In ILS, ongoing inflation will mean a continued focus on data quality and recency, as well as demands from investors for more sophisticated techniques to adjust for inflation and improve product performance.

In the context of limited capacity, these will be the differentiators that influence allocators.

A significant uplift in cat reinsurance attachment points in the 1 January renewal is a key achievement that ILS managers can point at to demonstrate to investors a reduced exposure to secondary peril and lower risk of attritional level in an inflationary environment.

More top-layer coverage also tended to provide limited coverage for peak perils, although as noted, take-up of named perils more broadly was not as widespread as some might have hoped. However, within the retro markets, peak named peril coverage has become more standard.

Platform evolution

As we noted last year, new leadership coming in at several of the aligned ILS platforms – including AlphaCat, Axis, Mt Logan, Lancashire and PartnerRe – opened the possibility for these businesses to redefine their proposals.

Meanwhile, non-aligned platforms also have their share of identity issues to settle. For example, Aeolus set back a rated launch in late 2021, but is still seen as likely to seek to broaden its suite of funds in future.

More generally, as we covered last summer, succession planning remains an issue for owner-led businesses in the industry.

However, there were few major strategic shifts apparent in 2022. One example was Axis Re’s exit from cat reinsurance, which will push its ILS offering further toward specialty or primary risk-sharing.

Nephila advanced its plans within the net-zero investing sphere, whilst Swiss Re’s opening of its cat bond fund to third-party investors signalled a more determined phase of competition with asset managers.

But in general, Hurricane Ian and macro-economic challenges meant that 2022 saw managers setting their heads down against multiple oncoming headwinds, rather than be an evolutionary year.

This year, it may be that investor response to the 2017-2023 high cat loss phase, as well as the dent from years of a lack of performance fee income, will prove more decisive in driving strategic shifts across the sector. Aligned managers who are generally content to keep more risk at this point in the cycle may need to decide how committed they are to their ILS franchises.

Not many people would be brave enough to predict a quiet year ahead, but as the industry adjusts to operating with a new base level of unpredictability in the macro sense, we can expect some re-positioning ahead.